Pay stubs are more than just a record of your paycheck—they are a critical tool for understanding how your income is taxed and ensuring that your tax withholdings are accurate. For both employees and employers, pay stubs provide a detailed breakdown of earnings, deductions, and contributions to government programs.

One of the most crucial aspects of a pay stub is how it reflects federal and state taxes. Understanding this can help you manage your finances, avoid surprises during tax season, and ensure compliance with tax laws.

What is a Pay Stub?

A pay stub, also known as a paycheck stub or earnings statement, is a document provided by an employer that accompanies an employee’s paycheck. It details how gross income is distributed, including deductions, taxes, and net pay. Pay stubs can be provided in paper form, via email, or through secure online payroll systems.

Typically, a pay stub includes:

- Employee information (name, address, Social Security number or last four digits)

- Employer information (company name, address)

- Pay period dates

- Gross earnings

- Deductions (taxes, benefits, retirement contributions)

- Net pay (take-home pay)

The deductions section is where state and federal taxes are clearly outlined, providing transparency and helping employees track their tax liabilities.

Federal Taxes on Pay Stubs

Federal taxes are mandated by the U.S. government and fund national programs such as Social Security, Medicare, defense, infrastructure, and public services. The primary federal taxes reflected on pay stubs include:

1. Federal Income Tax (FIT)

Federal income tax is calculated based on your earnings and the information you provide on your W-4 form. Your W-4 indicates your filing status, number of allowances, and any additional amounts you wish to withhold. Employers use this information to determine how much federal tax to deduct from each paycheck.

On a pay stub, the federal income tax deduction is usually listed as “Federal Withholding” or “FIT”. This amount reduces your gross pay and contributes to your annual federal income tax obligation.

2. Social Security Tax

Social Security tax is a payroll tax that funds the Social Security program, which provides retirement, disability, and survivor benefits. As of 2025, employees contribute 6.2% of their wages up to the annual wage limit. This contribution is automatically withheld by the employer and reflected on the pay stub under “Social Security Tax”.

3. Medicare Tax

Medicare tax is another federal payroll tax that funds the Medicare healthcare program for seniors and certain disabled individuals. Employees contribute 1.45% of their wages, with no income cap. High earners may be subject to an additional 0.9% Medicare surtax on wages exceeding $200,000. On a pay stub, this appears as “Medicare Tax”.

These federal taxes combined are often labeled “FICA” (Federal Insurance Contributions Act), which represents both Social Security and Medicare contributions.

State Taxes on Pay Stubs

State taxes vary depending on where you live and work. Not all states impose income taxes, but those that do generally withhold state income tax from employee paychecks. Common state taxes reflected on pay stubs include:

1. State Income Tax

State income tax functions similarly to federal income tax but is imposed at the state level. The rate may be flat or progressive, depending on state laws. Employees may adjust withholding using state-specific forms, similar to the W-4. On a pay stub, this is usually labeled as “State Withholding” or includes the state’s abbreviation (e.g., “CA Tax” for California).

2. State Disability Insurance (SDI) and Other Local Taxes

Some states, like California, require employees to contribute to state disability insurance, which provides partial wage replacement in case of disability. Local taxes, such as city or county taxes, may also appear on your pay stub, depending on your location.

3. Unemployment Insurance Contributions

In some states, employees contribute a small portion of wages toward state unemployment insurance programs. While often modest, these contributions are recorded on the pay stub to maintain transparency.

How Pay Stubs Make Tax Deductions Transparent?

Pay stubs are designed to show employees exactly how their earnings are distributed. By itemizing deductions, pay stubs allow employees to:

- Track Tax Contributions: See how much is being withheld for federal, state, and local taxes.

- Verify Accuracy: Ensure the employer is withholding the correct amounts to avoid underpayment or overpayment of taxes.

- Plan Finances: Understand take-home pay and budget accordingly.

- Prepare for Tax Filing: Use cumulative tax data on pay stubs to file federal and state tax returns accurately.

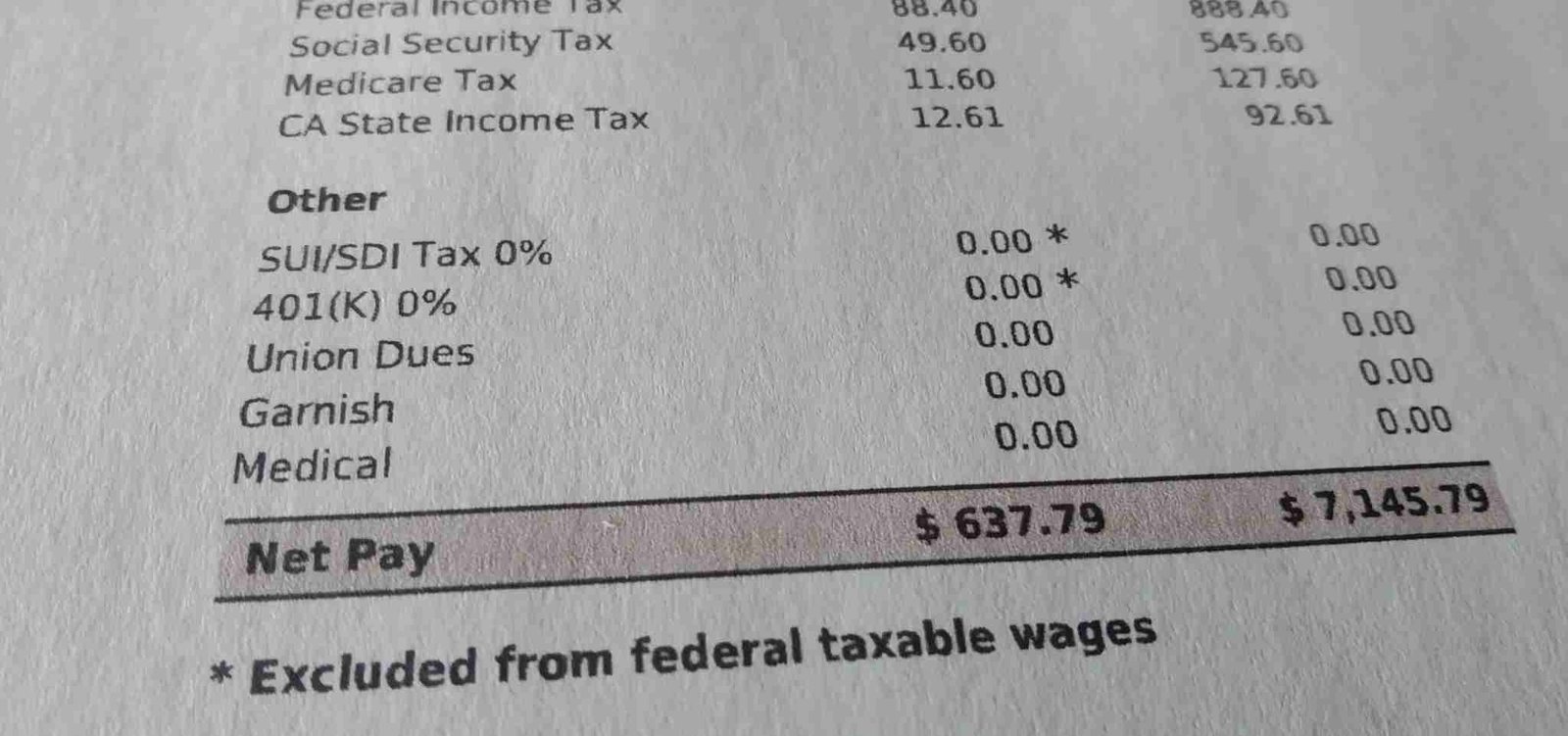

Example

For instance, if an employee earns a gross pay of $3,000 in a bi-weekly pay period, the pay stub might reflect the following deductions:

- Federal Income Tax: $350

- Social Security Tax: $186

- Medicare Tax: $43.50

- State Income Tax (e.g., California): $120

- SDI: $45

The total deductions of $744.50 result in a net pay of $2,255.50. By examining the pay stub, the employee can clearly see how federal and state taxes impact their take-home pay.

Common Issues With Tax Withholding on Pay Stubs

While pay stubs are generally accurate, errors can occur:

- Incorrect W-4 Information: If the employee hasn’t updated their W-4 after major life events, withholding may be incorrect.

- Employer Errors: Mistakes in payroll systems can lead to over- or under-withholding of taxes.

- State-Specific Complexities: Employees working in multiple states may face withholding challenges.

Employees should review their pay stubs regularly and consult payroll or HR departments if discrepancies arise.

Tips for Understanding Tax Deductions on Pay Stubs

- Keep Records: Save pay stubs for tax filing and financial planning.

- Check Withholding: Use the IRS Withholding Calculator to ensure the right federal tax is being withheld.

- Understand State Rules: Know your state’s income tax and other contributions.

- Review Benefits Deductions: Some deductions, like retirement contributions or health insurance premiums, can impact taxable income.

Conclusion

Pay stubs are more than a receipt of your earnings—they are a window into how your wages are taxed at both the federal and state levels. By understanding the various deductions and how they are calculated, employees can make informed decisions, avoid surprises during tax season, and maintain accurate financial records. Regularly reviewing pay stubs ensures transparency, accuracy, and peace of mind in managing your income and tax responsibilities.